You probably know how many individual bank accounts you have; but, how many do you really need? If you have a different bank account for each different fund, that really isn’t necessary when you have true fund accounting software. Pooled bank accounts (one bank account with multiple funds) aid in cash management and make it easier to keep up with cash flow. Should you have interest-bearing accounts, consolidation (pooling) could help maximize those earnings. Or, perhaps you’ve forgone interest bearing accounts (understandable since the rates are really low) for a decrease in bank fees. Pooling of cash could result in even lower, overall fees.

You probably know how many individual bank accounts you have; but, how many do you really need? If you have a different bank account for each different fund, that really isn’t necessary when you have true fund accounting software. Pooled bank accounts (one bank account with multiple funds) aid in cash management and make it easier to keep up with cash flow. Should you have interest-bearing accounts, consolidation (pooling) could help maximize those earnings. Or, perhaps you’ve forgone interest bearing accounts (understandable since the rates are really low) for a decrease in bank fees. Pooling of cash could result in even lower, overall fees.

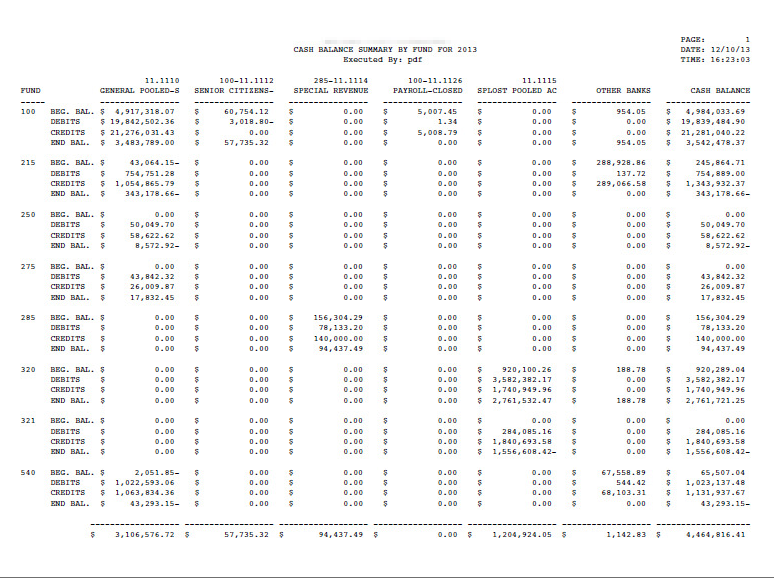

So, how does this work? Each separate bank account must be associated with a unique cash (balance sheet) code. Think of this as the “pool” definition. Then with several of OpenRDA’s standard reports (an example is below), it’s easy to see each fund’s share of the bank account. Have some funds that are subsidized by other funds? Then those funds will show a negative (credit) balance until “paper” transfers are made to those funds. If you want a copy of my problem/solution white paper on pooled bank accounts, let me know by adding comments to this blog or emailing me (whether you want the white paper or not, I always appreciate comments on my blog postings).

And, I must say that after our recent Polar Vortex here in the South, the pool in this week’s image is very appealing!

Phyllis

pdflowers@openrda.com